The smart Trick of Your Home And Garden That Nobody is Talking About

Wiki Article

8 Simple Techniques For Your Home And Garden

Some loan providers require you to pay your home tax obligations as well as your home owners insurance as component of your home mortgage payment. Discover all the cost components that make up a regular mortgage payment, as well as utilize our to estimate your regular monthly home loan settlement. You generally have to pay sales tax obligation when you acquire something in a shop.

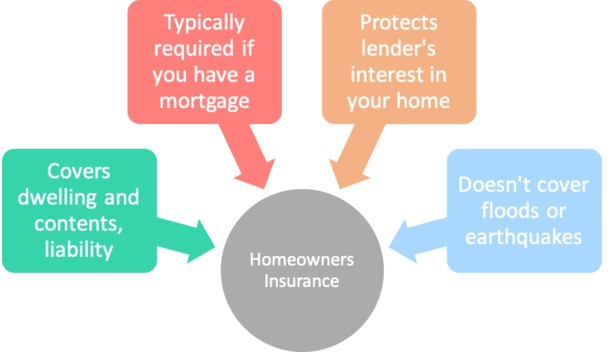

On most rides, you won't need to depend on it, yet the one-time you diminish your bike, it might save your life. Even if you believe you don't require house insurance, many home mortgage lending institutions require you to have it. There are two primary sorts of home owners insurance coverage: house as well as personal effects insurance coverage.

The cost changes based upon your level of insurance coverage as well as place. However on average, property owner's insurance costs around $1,428 per year for a plan with $250,000 in house protection. When determining on how much coverage to acquire, take into consideration exactly how much it would certainly set you back to rebuild your house as opposed to checking out just how much your home is worth.

The Best Strategy To Use For Your Home And Garden

You can likewise consider some preferred budget friendly upgrades to potentially improve your house's worth (which could cause a greater price need to you make a decision to relocate). Maintenance costs differ commonly, whether you a house. Energies might not be top of mind when it involves homeownership expenses, yet whether it's your electrical power, water, a/c, warmth or Wi, Fi they are hard to live without as well as rates can vary based on your place as well as dimension of your house (also the age of you're A/C can impact your expenses).

The last thing you want to fret around as a property owner is pests attacking your house. You may require to buy professional insect control to maintain critters out of your space. You can anticipate to pay in between $400 and $950 yearly for general, full-service pest control, but the expense can vary depending upon your conditions.

Your residence may have major appliances, such as an oven, stove, fridge and dishwashing machine. If your residence lacks any home appliances you can't live without, you'll require to begin saving for them. New appliances can vary widely depending on the type, model and tier (varying in ordinary between $350 and also $8,000), so be certain to make up any missing out on devices while you house hunt.

Little Known Facts About Your Home And Garden.

Consider spending some time staying in the space to figure out your precise requirements in terms of storage space, company and design. Take inventory of pieces you currently have that you intend to bring right into your new home and also begin saving for those down the roadway. If you wish to furnish your whole house, the ordinary cost is $16,000.

https://writeablog.net/urh0megarden/html

You'll be a lot more prepared to take the leap when you pass the number crunching (as well as anticipating the unanticipated). Attempt using an expense of homeownership calculator to assist you calculate the real prices. Keep in mind that you'll experience different prices if you mean to.

Advertisements by Cash. Advertisement The real estate market has actually been kind to property owners these last few years. The average home worth has actually leapt 43% given that late 2019, and also vendors have actually raked in eye-popping revenues due to the fact that of it.

The smart Trick of Your Home And Garden That Nobody is Talking About

Home sales have actually reduced 6% contrasted to last year, and rates have already begun to drop (at least month-to-month). "The majority of forecasts are currently requiring a decline in residence prices following year," states Kenon Chen, executive vice president of corporate approach at Clear Funding, a property data and modern technology provider.

For others, there may be some financial savings to be had. As Jessica Peters, a real estate broker with Douglas Elliman, places it, "Prices will trend downward, however that does not always suggest ruin and grief." Which team do you fall into? Right here's what reduced house worths would really mean for home owners and who should (as well as should not) be fretted.

"If you acquired your residence in 2008 or 2009, selling in 2023 will still pay for you," states Maureen Mc, Dermut, an actual estate representative with Sotheby's International Realty in Santa Barbara, The Golden State. "If you got in 2021 and also intend to sell in 2023, then you might finish up taking a loss.

Excitement About Your Home And Garden

We may be compensated if you click this ad. Advertisement Decreasing house values would certainly additionally imply less equity for homeowners throughout the board. Home equity or the difference between your residence's present value and any kind of home loan lendings linked to it has actually skyrocketed recently. The typical American homeowner gained $60,000 of it in the in 2014 alone.

The even more equity you have, the more you stand to acquire when you offer. A read the article lot more than this, equity is likewise an economic tool. You can obtain against it utilizing a cash-out refinance, house equity lending or residence equity credit line (HELOC) and also transform it into money without marketing.

If equity decreases, however, home owners will certainly have the ability to obtain much less or maybe not be qualified for these kind of products in all. This can be huge considering just how prominent HELOCs have come to be in recent months. In the initial half of 2022, HELOC borrowing reached its acme in 15 years, leaping 30% compared to 2021.

Not known Details About Your Home And Garden

"If a property owner thinks they might need to use several of that equity, it's better to obtain that HELOC in area now." Those that currently have HELOCs might see their credit lines reduced or frozen significance they will not be able to withdraw additional funds. Lenders do this to avoid consumers from overleveraging.

https://calendly.com/urh0megarden/urh0megarden?month=2023-08

If this were to take place and you required to market, the home would not make sufficient to repay your complete loan equilibrium. You 'd then either deal with a brief sale when you market your residence at a high price cut and settle what you can (with your loan provider's authorization initially) or a repossession, in which the bank takes your home as well as sells it off for you.

Report this wiki page